Credit Score

30 Minutes callback Guarantee !!!! QuickapplyUAE

What is a Credit Score in the UAE?

In simple terms, a credit score is a three digit number that represents your creditworthiness. It’s a statistical summary of your financial history and behavior, used by banks and financial institutions to assess the risk of lending you money or providing you with credit.

Think of it as your financial report card. A high score tells lenders you are a responsible and low-risk borrower, while a low score suggests you might be a higher risk.

The Key Player: Al Etihad Credit Bureau (AECB)

In the UAE, the primary organization responsible for calculating and providing credit reports and scores is the Al Etihad Credit Bureau (AECB). The AECB collects data from all banks and financial institutions in the UAE to create a centralized profile for every resident.

The AECB Credit Score Range

The AECB credit score ranges from 300 to 900.

- Excellent (781 – 900):You are a very low-risk customer. You will likely get approved for loans and credit cards easily, often with the best interest rates and preferential terms.

- Good (681 – 780):You are a reliable borrower. Approval is likely, and you should still receive competitive offers.

- Fair (581 – 680):You are considered an average or moderate risk. You may still get approved, but possibly with higher interest rates or lower credit limits.

- Poor (300 – 580):You are considered a high-risk borrower. Getting new credit will be difficult, and if approved, it will likely come with very high-interest rates and strict conditions.

Why is Your Credit Score Important in the UAE?

Your credit score directly impacts your financial life in several ways:

- Loan Approvals:For personal loans, car loans, or mortgages.

- Credit Card Approvals:For new credit cards or increases to your credit limit.

- Interest Rates (Pricing):A higher score can help you secure loans with lower interest rates, saving you thousands of Dirhams over time.

- Security Deposits:Utility companies (like DEWA, Etisalat) may check your score. A poor score could lead to higher security deposit requirements.

- Employment:Some employers in the financial sector may check your credit report as part of their background check, as it can be an indicator of financial responsibility.

What Factors Affect Your UAE Credit Score?

The AECB calculates your score based on several factors from your credit report:

- Payment History (Most Important):Do you pay your credit card bills and loan EMIs on time? Late or missed payments severely damage your score.

- Credit Utilization Ratio:This is the amount of credit you are using compared to your total available limit. It is recommended to use less than 50% of your total credit limit, and ideally below 30%. Maxing out your cards is very bad for your score.

- Length of Credit History:How long have you had active credit accounts? A longer, well-managed history is beneficial.

- Total Debt:The overall amount of debt you have across all loans and credit cards.

- Number of Credit Applications (“Hard Inquiries”):Every time you apply for a loan or credit card, the lender makes a “hard inquiry” on your report. Too many applications in a short period can make you look desperate for credit and lower your score.

- Type of Credit:A healthy mix of different types of credit (e.g., a credit card and a car loan) can be positive, but this is a minor factor.

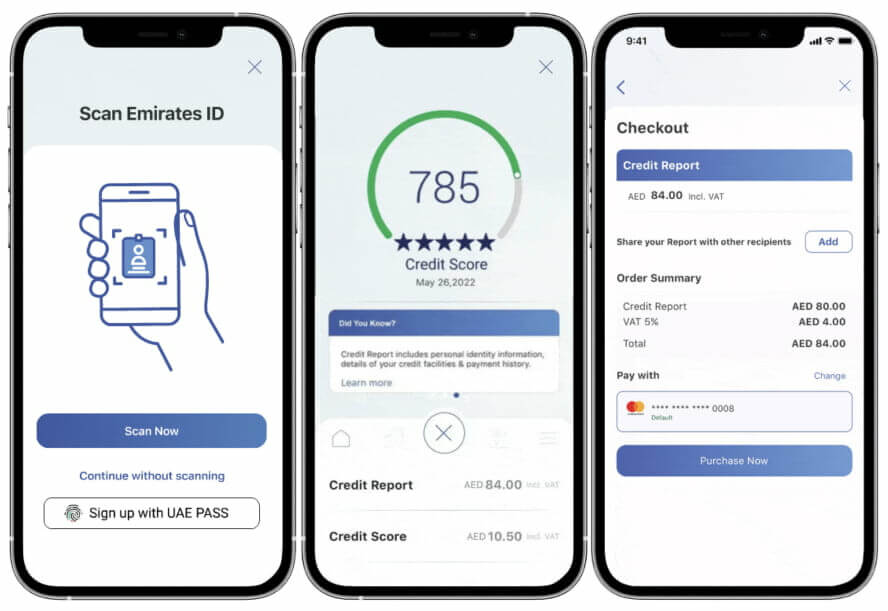

How to Check Your AECB Credit Report and Score

It’s highly recommended to check your own credit report regularly. You can do this easily:

- Online:Visit the Al Etihad Credit Bureau website.

- App:Download the “AECB” app from the Apple App Store or Google Play Store.

- ATM:Through selected bank ATMs (e.g., Emirates NBD, ADCB).

- Kiosks:At AECB kiosks located in certain shopping malls and government offices.

You will need to provide your Emirates ID and pay a small fee (e.g., around AED 84 for a score and report).

How to Build and Improve Your Credit Score in the UAE

If you are new to the UAE or have a low score, here’s how to build it:

- Get a Credit Card:If you have no history, start with a basic credit card, perhaps even a secured card (where you provide a cash deposit as collateral).

- Pay ALL Bills on Time:Set up auto-pay for your credit card and loan EMIs to never miss a due date.

- Keep Credit Utilization Low:Don’t max out your cards. Pay down your balances frequently to keep the utilization ratio low.

- Maintain Old Accounts:The age of your oldest account matters. Don’t close your first credit card unless it has a high fee.

- Limit Credit Applications:Only apply for new credit when you truly need it.

- Check Your Report for Errors:Regularly review your report for any inaccuracies (e.g., a loan that isn’t yours) and dispute them with the AECB immediately.

Common Misconceptions

- “My high salary means I have a good score.” Your salary is not part of your credit score. It determines your eligibility for a product, but your score is determined solely by how you manage the credit you are given.

- “I don’t have any debt, so my score must be high.” Having no credit history means you have no data to prove you are a reliable borrower. Lenders see this as “unproven” risk, which can be almost as bad as a poor score.

In summary, your credit score in the UAE is a critical tool for your financial health. Managing it responsibly opens doors to better financial products and saves you money.

What is Al Etihad Credit Bureau (AECB)?

Al Etihad Credit Bureau (AECB) is the UAE’s official credit bureau. It collects credit/repayment data from banks, lenders, telecoms, utilities and other relevant organizations, and produces **credit reports and credit scores** for individuals and companies. You can buy/view reports & scores via the AECB website or the AECB Credit Report mobile app (registration/ID verification required).

AECB credit score — how it works (quick facts)

Score range: 300 – 900** (higher = lower credit risk)

Typical interpretation (example ranges used by providers)

* 746–900 – Very High / Excellent

* 711–745 – High

* 651–710 – Medium

* 541–650 – Low

* 300–540 – Very Low / High risk.

Main factors that affect your AECB score: payment history, outstanding debt levels, credit utilization, credit mix (type of credit), age of credit history, number of recent credit applications (hard enquiries).

How lenders use it banks and finance companies check the AECB score/report when deciding on loans, credit cards, limits and pricing. A better score usually improves approval odds and may lead to better rates/limits.

How to get your AECB report & score

Official channels AECB website / AECB Credit Report mobile app. You can register using Emirates ID (UAE Pass flow is supported) and pay on the portal. Government portal guidance also lists Dubai Now / TAMM and other partner channels for access.

Typical cost published examples Many banks and guides note the individual credit report ~ AED 84 (incl. VAT) and the **credit score for a smaller fee (prices can vary slightly by channel). Always confirm the current price on the AECB site/app.

Practical tips to improve/maintain your AECB score

* Pay loans/credit card bills on time (biggest factor).

* Keep credit-card utilization low (don’t max out cards).

* Avoid multiple loan/card applications in a short period.

* Keep older accounts open where reasonable (age helps).

* Check your report regularly and dispute any errors via the AECB portal.

All banks in the UAE

The official, authoritative register of licensed banks in the UAE is published by the Central Bank of the UAE (CBUAE). The CBUAE maintains a register (PDF) of all licensed banks (local/national banks, fully-Islamic banks, and foreign banks operating in the UAE). The latest publicly available register I used is the CBUAE bank register (June 2025) If you need the absolutely up to the minute list, CBUAE is the source to check.

Below I list the major national (local) banks and many of the foreign banks licensed in the UAE as shown in the CBUAE register (June 2025). This is not an informal “top 10”it follows the CBUAE register structure (national banks, Islamic banks, foreign banks and specialized / investment banks).

Major national (conventional) & investment banks

* First Abu Dhabi Bank (FAB)

* Emirates NBD

* Mashreq Bank

* Ajman Bank

* RAKBANK (National Bank of Ras Al Khaimah)

* Commercial Bank of Dubai (CBD) / Commercial Bank International

* Abu Dhabi Commercial Bank (ADCB)

* National Bank of Fujairah (NBF)

* InvestBank P.J.S.C.

* National Bank of Umm Al Quwain (National Bank of U.A.Q.)

* United Arab Bank P.J.S.C.

* Bank of Sharjah

* Bank of Baroda (operates as a foreign branch but listed)

* National Bank of Bahrain (foreign)

* National Bank of Fujairah P.S.C

* National Bank of U.A.Q P.S.C

Major Islamic banks (fully Shariah-compliant)

* Dubai Islamic Bank (DIB)

* Abu Dhabi Islamic Bank (ADIB)

* Emirates Islamic Bank

* Sharjah Islamic Bank

* Ajman Bank

* Al Hilal Bank

* Ruya Community Islamic Bank

* Sharjah Islamic Bank P.J.S.C

Foreign banks (examples appearing in the CBUAE register

* HSBC Middle East / HSBC

* Citibank Dubai

* Standard Chartered Bank

* Barclays Bank PLC

* Bank of China (Industrial & Commercial Bank of China & other Chinese banks listed)

* Deutsche Bank AG

* BNP Paribas

* KEB Hana Bank

* Doha Bank

* Habib Bank Ltd.

* Bank Melli Iran

* Arab African International Bank

* Ruya Community Islamic Bank LLC

* BOK International Bank

* El Nilein Bank

Finance Companies & Non-Bank Financial Institutions

* Amlak Finance PJSC

* Tamweel PJSC

* AAFAQ – Islamic Finance PSC

* Mashreq Al Islami Finance Company PJSC

* Mawarid Finance PJSC

* Siraj Finance PJSC

* BMW Albatha Finance PSC