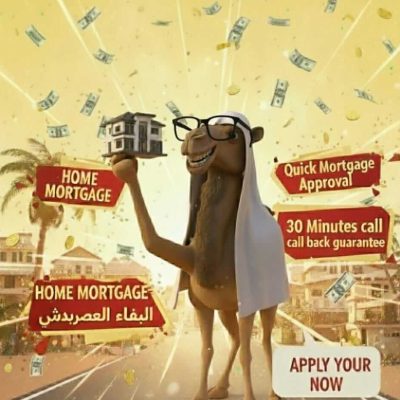

With QuickApplyUAE Get Instant Approval on Credit card, Loan, Mortgage & Car insurance

30 Minutes callback Guarantee !!!! QuickapplyUAE

QuickApplyUAE Your Gateway to Instant Financial Solutions

QuickapplyUAE delivers fast, reliable access to credit card, loans, mortgages, and Car insurance with guaranteed swift support.

Experience Fast Approvals and Tailored Solutions

QuickapplyUAE offers a seamless platform to apply for credit card, personal loans, mortgages, and car insurance with instant approval and a guaranteed callback within 30 minutes, ensuring convenience and peace of mind.

Instant Approval for Financial ProductsWide Range of Credit and Loan OptionsGuaranteed 30-Minute Callback ServiceSimple Online Application Process

How QuickapplyUAE Works

Follow these simple steps to apply online for credit card, loan, mortgage, and Car insurance with ease and confidence.

Step One: Choose Your Product

Select the financial product you need from our range, starting your quick and easy application journey.

Step Two: Submit Application

Complete the online form with your details to get instant approval and initiate your 30-minute callback guarantee.

Step Three: Get Approved

Receive prompt confirmation and personalized assistance to finalize your financial product smoothly and swiftly.

Apply for Financial Products Quickly and Securely

Get Instant Approval on Credit card, Loans, Mortgage & Car insurance

Discover our platform’s key benefits at a glance.

Instant Approval

Get your credit cards and loans approved within minutes.

30-Minute Callback Guarantee

We promise to call you back within half an hour.

Wide Range of Products

Choose from credit cards, loans, mortgages, and Car insurance.

Easy Online Application

Complete your applications effortlessly from anywhere.

Instant Online Approvals for Your Financial Needs

Discover how QuickapplyUAE simplifies access to credit card, loans, mortgage, and insurance with fast, reliable service.

Credit Card Made Easy

Apply for top credit cards online and receive instant approval to start enjoying benefits without delay.

Fast Personal Loan Processing

Get personal loans approved quickly with our hassle-free application and 30-minute callback guarantee.

Simplified Mortgage Applications

Secure your dream home with straightforward mortgage approvals and expert support every step of the way.

Skip the Hassle of Financial Paperwork Today and Get Instant Approval on Credit card, Loans, Mortgages & Car insurance

Hear from our users who have trusted QuickapplyUAE for fast and seamless financial approvals.

“Applying was effortless, and the instant approval saved me so much time. Highly recommend QuickapplyUAE!”https://quickapplyuae.ae/loan/

From Pearls to Digital Transactions: The Story of UAE Banking

The Humble Beginnings: Before the Union

Before the discovery of oil, the region’s economy was built on pearls, fishing, and trade. Banking, as we know it, didn’t exist. Transactions were based on trust, personal relationships, and a handshake. Merchants and money changers (known as sarrafs) were the pillars of the financial system, dealing in a multitude of currencies from the busy trade routes.

was British Bank of the Middle East (BBME) in Dubai in 1946, followed by branches in Sharjah and Abu Dhabi. For a long time, it was the only game in town, primarily serving the major merchants and ruling families.

The Foundation: The 1960s & 1970s

The 1960s saw the entry of other international banks, but the true revolution came with the formation of the United Arab Emirates in 1971. The founding father, the late Sheikh Zayed bin Sultan Al Nahyan, and his fellow rulers had a clear vision: to build a modern, sovereign nation.

A critical part of that vision was a robust, local financial system. This led to the creation of two foundational pillars:

The UAE Currency Board (1973):The first step was replacing the Bahraini Dinar and Qatari Riyal with a single, national currency the UAE Dirham (AED). This was a powerful statement of economic identity.

The Central Bank of the UAE (1980):To oversee this growing financial landscape, the Central Bank was established. Its job was monumental: to manage monetary policy, ensure stability, regulate banks, and foster confidence in the system.

This era also saw the birth of the UAE’s “national champions”banks created by Emiri decree to ensure local capital funded local growth. Giants like Emirates NBD (from the merger of National Bank of Dubai and Emirates Bank International) and First Abu Dhabi Bank (FAB) (from the merger of National Bank of Abu Dhabi and First Gulf Bank) have their roots in this foundational period.

The Modern Era: Diversification and Digital Leap

So, How Many Banks Are Operating in the UAE Today?

First Abu Dhabi Bank (FAB)

Emirates NBD

Abu Dhabi Commercial Bank (ADCB)

Dubai Islamic Bank (DIB)

Mashreq Bank

Commercial Bank of Dubai (CBD)

Abu Dhabi Islamic Bank (ADIB)

Sharjah Islamic Bank (SIB)

RAKBANK (The National Bank of Ras Al-Khaimah)

Union National Bank (UNB) (Now part of FAB following merger)

Al Hilal Bank

Invest Bank

Commercial Bank International (CBI)

National Bank of Fujairah (NBF)

National Bank of Umm Al Qaiwain (NBQ)

Ajman Bank

These are the UAE branches of major international banks, catering to corporate clients, wealth management, and specific international niches.

HSBC Bank Middle East Limited

Standard Chartered Bank

Citibank N.A.

BNP Paribas

Barclays Bank PLC

Bank of Baroda

Habib Bank AG Zurich

Sberbank

National Bank of Bahrain

Qatar National Bank (QNB)

And several others from across the globe.

Representative Offices (20 Banks)

The Modern Powerhouse (2000-Present)

Emirates NBD was formed from NBD and EBI, and First Abu Dhabi Bank (FAB) was created from the merger of NBAD and First Gulf Bank, creating the region’s largest bank.

Surviving Global Shocks:The 2008 global financial crisis and the 2014 oil price crash tested the system, but the strengthened regulations and large capital buffers of the national banks allowed them to emerge more resilient.