What Is a Credit Score in the UAE? step by Step with Quickapplyuae.ae

Your credit score in the UAE is a 3-digit number (from 300 – 900) that reflects how likely you are to repay borrowed money.

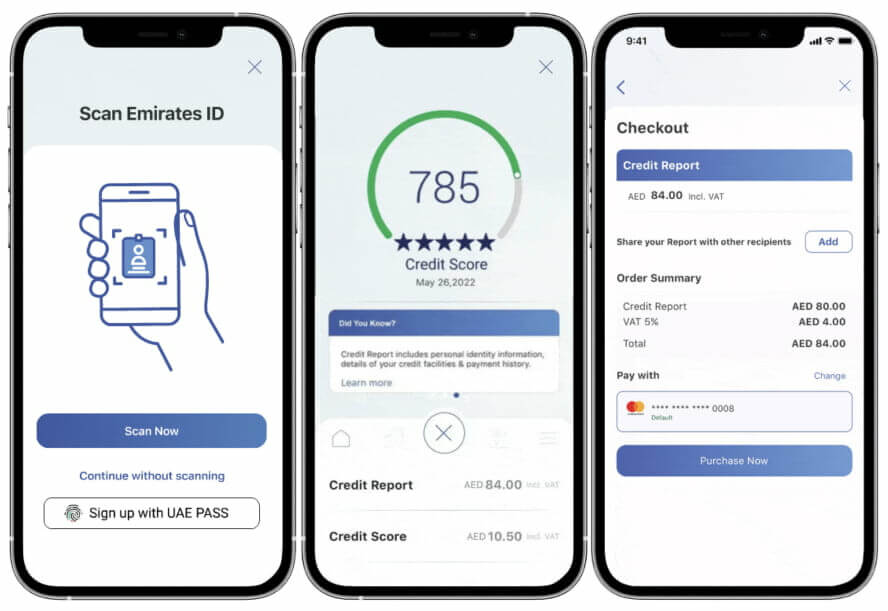

Credit Score only: AED 10.50

Credit Report + Score:AED 84

It’s issued by the Al Etihad Credit Bureau (AECB) the only official credit bureau in the UAE.

300–619 = Poor

620–719 = Fair

720–819 = Good

820–900 = Excellent

It summarizes your

Loan and credit card history

Payment punctuality

Outstanding balances

Number of credit inquiries

Bounce cheque records (if any)

2. Where to Check Your Credit Score

You can check your UAE credit score through AECB in three main ways:

Option 1 — AECB Website

Step-by-step:

1. Go to https:/aecb.ghttps://etihadbureau.ae/ov.ae

2. Click on Get Your CreditScore or Get Your Credit Report

3. Sign up or log in using:

4. Your Emirates ID number

5. Your mobile number (linked to Emirates ID)

6. Verify via OTP

7. Pay the fee

8. Download your credit score or report (PDF) instantly

Fees:

Credit Score only: AED 10.50

Credit Report + Score:AED 84

Option 2 AECB Mobile App

Available on:

�� App Store (iOS)

�� [Google Play]

Steps:

1. Install and open the app

2. Sign up using your Emirates ID & mobile number

3. Verify via OTP

4. Choose “Get My CreditReport” or “Check My Score”

5. Pay via card or Apple Pay

6. View/download your report instantly

Option 3 AECB Customer Happiness Centers

You can visit in person:

Abu Dhabi: Al Etihad Credit Bureau HQ, Al Jazira Sports Club

Dubai: Central Park Towers, DIFC

Bring:

* Emirates ID (original)

* Passport & valid UAE Visa (for expats)

You can request your printed report there.

3. What’s included in Your Credit Report

Your credit report includes:

Personal info (ID, address, contact)

List of loans and credit cards

Payment history (last 24 months)

Late payments / defaults / bounced cheques

Total debt exposure

Credit scoreand risk summary

4. Tips to Improve Your UAE Credit Score

1. Pay on time: Even one late payment can drop your score.

2. Keep credit utilization below 30%. (Don’t max out cards.)

3. Avoid frequent loan or card applications. Too many = High risk.

4. Don’t close old credit cards abruptly; they help build history.

5. Monitor your report every 6 months to catch errors.

5. Bonus: Quick Links

AECB Official Site (https://www.aecb.gov.ae) (https://www.aecb.gov.ae)

AECB App (iOS):

AECB App (Android)